You can get a mortgage from a bank, cooperative credit union, or online lender. Trustworthy's online loan market can assist you find out how much you can borrow, get pre-approved, and compare lending institutions. You can compare prequalified rates from all of our partner lenders in the table listed below in just a few minutes.

Usually, a sizable down payment, high credit rating, longer loan term, and low home mortgage APR can help make your mortgage payment inexpensive. Pointer: Keep in mind that if you choose the longer loan term, you pay more interest over the life of the loan. The homebuying timeline can extend over several months.

Here are the huge parts of the procedure: Evaluation your credit report. You might get approved for a traditional mortgage with a credit report around 620 or higher, and government-insured loans have more flexible requirements. However if your rating is on the low side, try to enhance your credit rating before applying.

Get pre-approved. Ask a lending institution for a home loan pre-approval. This letter tells you how much you certify to obtain based on your credit, earnings, and other aspects. A pre-approval can help you approximate your home spending plan and make a strong offer on a home. You'll need a recent tax return, pay stubs, W-2, and bank declarations for the pre-approval process.

Even a somewhat lower home loan rate can help you conserve a lot of money over the loan term, so it is very important to compare several lending institutions. Trustworthy lets you do this by submitting a single kind. Negotiate the home purchase and complete the application. A genuine estate representative can assist you through the homebuying process, like scheduling home provings and working out the purchase.

Get approved and close on your mortgage. Your lender will go through all your information to make certain you can afford the loan. They'll validate your income, review your debts, and pull your credit. They'll also validate the value of the home through an appraisal. Once the lender approves your ebay timeshare home loan, you'll sign paperwork promising to repay https://postheaven.net/cillen8hbi/whether-youand-39-re-already-sure-an-fha-loan-is-right-for-you-or-youand-39-re the loan.

The Greatest Guide To How Often Do Underwriters Deny Mortgages

Reliable makes comparing several loan providers quick and easy, supplying real prequalified rates in minutes without impacting your credit report. It just takes 3 minutes to see if you qualify for an instantaneous structured pre-approval letter, without impacting your credit. Compare rates from numerous loan providers without your data being sold or getting spammed.

Talk with a loan officer just if you wish to. 1 About the author Kim Porter Kim Porter is a professional in credit, home mortgages, student loans, and debt management. She has been featured in U.S. News & World Report, Reviewed. com, Bankrate, Credit Karma, and more. Home All Home loans.

Because individuals frequently don't have enough cash readily available to acquire a house outright, they usually secure a loan when purchasing realty. A bank or mortgage lending institution concurs to supply the funds, and the debtor accepts pay it back over a particular amount of time, state thirty years.

Depending on where you live, you'll likely either sign a mortgage or deed of trust when you secure a loan to buy your home. This file provides security for the loan that's evidenced by a promissory note, and it develops a lien on the residential or commercial property. Some states use home mortgages, while others use deeds of trust or a similarly-named document.

While many people call a home mortgage a "mortgage" or "mortgage," it's in fact the promissory note which contains the promise to repay the amount obtained. Home loans and deeds of trust generally contain an acceleration provision. This provision lets the loan provider "speed up" the loan (state the whole balance due) if you default by not making payments or otherwise violate your loan agreement, like stopping working to pay taxes or preserve the needed insurance coverage.

A lot of home loan customers get an FHA, VA, or a traditional loan. The Federal Housing Administration (FHA) guarantees FHA loans. If you default on the loan and your house isn't worth enough to totally repay the debt through a foreclosure sale, the FHA will compensate the loan provider for the loss. A customer with a low credit rating might want to consider an FHA loan since other loans usually aren't offered to those with bad credit.

Excitement About Which Credit Report Is Used For Mortgages

Department of Veterans Affairs (VA) guarantees. This kind of loan is just readily available to specific debtors through VA-approved lending institutions. The guarantee suggests that the lending institution is secured against loss if the borrower stops working to repay the loan. A current or previous military servicemember might wish to think about getting a VA loan, which might be the least expensive of all three loan types.

So, unlike federally insured loans, traditional loans bring no assurances for the loan provider if you fail to pay back the loan (what are today's interest rates on mortgages). (Discover more about the distinction in between traditional, FHA, and VA loans.) Homebuyers in some cases believe that if a lender pre-qualifies them for a home mortgage loan, they have actually been pre-approved for a mortgage.

Pre-qualifying for a loan is the initial step in the home loan procedure. Usually, it's a pretty simple one. You can pre-qualify rapidly for a loan over the phone or Internet (at no charge) by offering the loan provider with a summary of your finances, including your income, properties, and debts. The lending institution then does a review of the informationbased on only your wordand offers you a figure for the loan amount you can most likely get.

It is necessary to comprehend that the lending institution makes no guarantee that you'll be approved for this quantity. With a pre-approval, though, you provide the home mortgage lending institution with details on your income, properties, and liabilities, and the lending institution verifies and examines that details. The pre-approval process is a much more involved procedure than getting pre-qualified for a loan.

You can then try to find a house at or below that price level. As you might think, being a pre-approved buyer brings much more weight than being a pre-qualified buyer when it pertains to making an offer to purchase a house; as soon as you discover the home you desire and make a deal, your deal isn't contingent on acquiring funding.

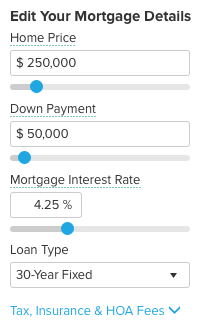

Jointly, these products are called "PITI." The "primary" is the amount you borrowed. For instance, expect you're buying a home that costs $300,000. You put 20% of the home's price down ($ 60,000) so that how to get out of westgate timeshare you can avoid paying private home mortgage insurance coverage (PMI), and you borrow $240,000. The primary amount is $240,000.